cypruswell

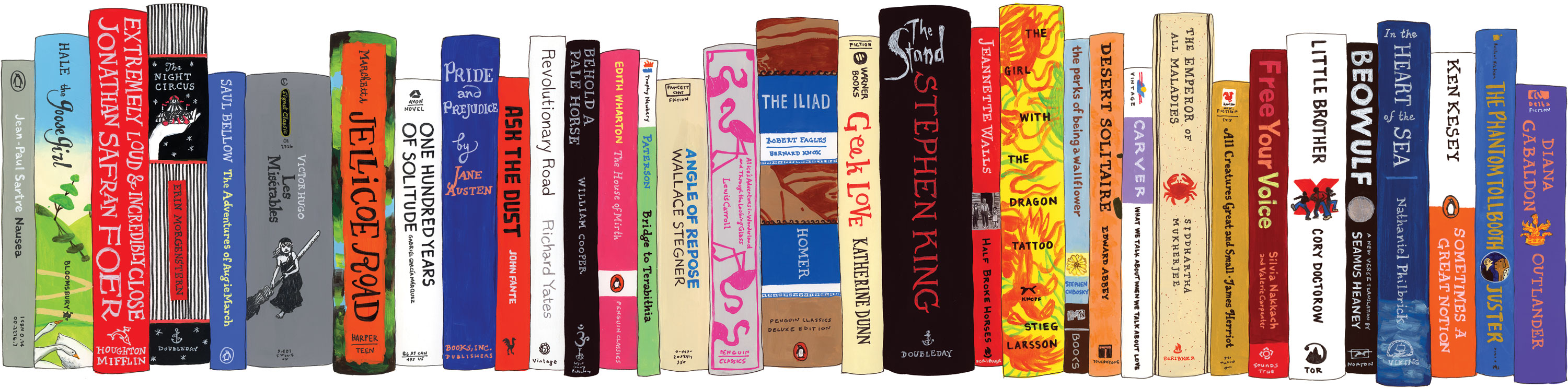

Literature for everyoneBuying A Pension Annuity

Tuesday , 26, April 2022 Business and Management Comments Off on Buying A Pension AnnuityYou've built up an adequate private pension fund through your working years and you're planning to end your work and retire.

Your pension fund's provider has provided the 60 pages of a document to you to go through and take one of the biggest choices in your lifetime. What is the most effective method to convert your pension into income?

One of the most common and popular methods to convert your pension savings into income is to purchase an annuity. You can hire a pension adviser to know more about pension annuity.

Image Source: Google

They are straightforward to understand in that you are making a one-time choice that you will live with for the rest of your life.

In addition, it takes away any investment risk. You hand over your PS100,000.00 pension funds to a reputable annuity company and they promise to provide you a regular income for the duration of your lives. You can estimate your income potential with this annuity calculator.

Annuity providers are aware that if they draw in the right amount of pension funds from retired people and then pay them an annuity, people who die early will be more than offset by those who live more than the standard life expectancy.

Their main business is the provision of annuities and all it comes directly to mortality charts, which are hidden within their department of actuarial.